vehicle personal property tax richmond va

The property taxes on motor vehicles and trailers are prorated based on the date of purchase or the date the vehicle acquires taxable situs in the City of Richmond on an even month basis. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329.

101KB Personal Property Tax Relief Act of 1998.

. To help vehicle owners the Fairfax County Board of Supervisors approved 15 tax relief for personal property taxes as part of their FY 2023 budget markup. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. If you sell or dispose of a vehicle s you must report within 30 days.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. The 10 late payment penalty is applied December 6 th. Personal Property Tax Rate.

Personal Property taxes are billed annually with a due date of December 5 th. Schedule one time or periodic automatic payments with Flex-Pay. Thoroughly determine your actual property tax applying any exemptions that you are allowed to have.

This will depend upon the value of the car at the first of the year. The current rate is 350 per 100 of assessed value. In total the county returned 30 million to taxpayers to mitigate the.

Tax Return Filing Date A Tangible Personal Property Blue Form is mailed out at the end of each year showing what is on the current tax roll. Interest is assessed as of January 1 st at a rate of 10 per year. Vehicle Personal Property Tax Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

Press J to jump to the feed. Cut the Vehicle License Tax by 50 to 20. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

Emailed receipts provide electronic payment history without the paper. Team Papergov 1 year ago. It is an ad valorem tax meaning the tax amount is set according to the value of the property.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Before you do look at what the assessment actually does to your yearly tax payment. PLEASE NOTE The COVID-19 pandemic has made the current prices in the auto market increase by over 10 over the summer of 2020.

So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. A higher-valued property pays more tax than a lower-valued property. This was due to demand outpacing supply which occurred both as a result of large fleet companies holding.

Personal Property Taxes are billed once a year with a December 5 th due date. The tax rate is 1 percent charged to the consumer at the time of rental payment. This measure cost the county over 7 million.

The County bills personal property taxes in halves with first half taxes being due by June 5th and second half due by December 5th. Vehicle sales and use tax is 3 of the sale price. National Automobile Dealers Association NADA Pricing Guide.

The personal property tax is calculated by multiplying the assessed value by the tax rate. Farm animals except as exempted under 581-3505. The current tax rate is 350 per hundred dollars of assessed value.

Tangible personal property is classified for valuation purposes according to the following separate categories which are not to be considered separate classes for rate purposes. I need to get my cars or trucks license plates renewed. WRIC The Henrico Board of Supervisors voted this week to approve an emergency ordinance that would extend the deadline for personal property taxes from June 6 to August 5.

Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD. Personal Property Tax. If a vehicle is purchased before the 15th of the month that entire month counts in the proration of the vehicle for tax purposes.

Effective July 1 2016 unless exempted under Va. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Example Calculation for a Personal.

HENRICO COUNTY Va. The Board of Supervisors sets new tax rates approximately April of each year. The personal property tax rate is determined annually by the City Council and recorded in the budget appropriation ordinance each year.

Every year I wonder what the license fee is on my personal property tax bill for my car so I finally emailed the city and asked. Personal Property Taxes. This will be a continuous tax to figure in your costs.

What seems a large increase in value may actually turn into a tiny increase in your property tax bill. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee. Protesting your propertys tax valuation is your right.

After the public hearing on June 14 the board is scheduled to vote to ratify the ordinance which would allow residents to pay their personal property taxes and vehicle license taxes through Aug. Virginia taxes your automobiles every year as a property tax. Is more than 50 of the vehicles annual mileage used as a business.

Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. A vehicle registration fee continues to be assessed on each of the above personal property types according to class and weight. Personal Property Registration Form An ANNUAL filing is required on all.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Pay Online Chesterfield County Va

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Virginia Property Tax Calculator Smartasset

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

News Flash Chesterfield County Va Civicengage

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

28 Key Pros Cons Of Property Taxes E C

Real Estate Tax Exemption Virginia Department Of Veterans Services

Real Estate Tax Frequently Asked Questions Tax Administration

Eliminating Virginia S Vehicle Property Tax Isn T Part Of Glenn Youngkin S Tax Relief Plan Wset

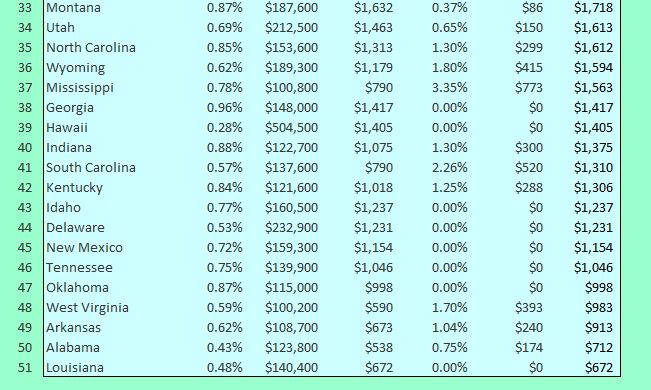

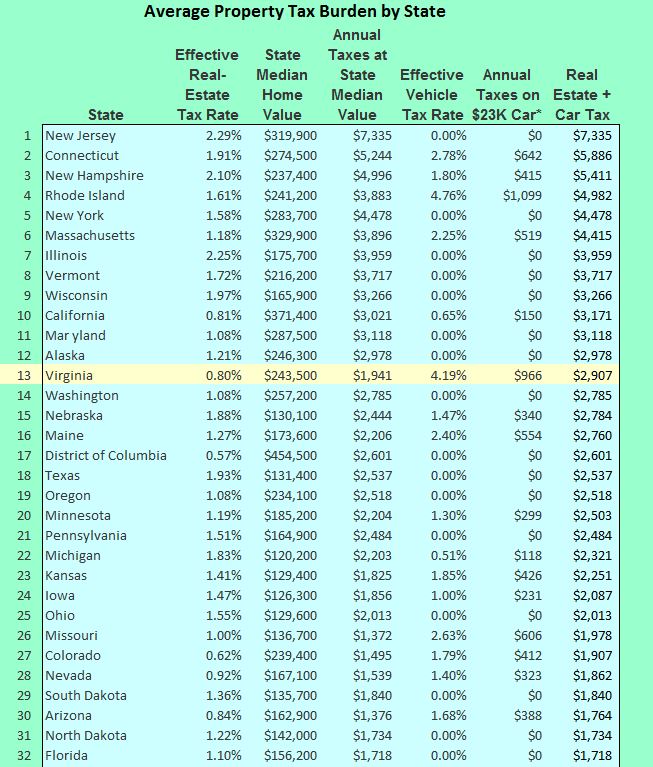

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Personal Property Vehicle Tax City Of Alexandria Va

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Solving Richmond S Money Problem Richmondmagazine Com

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion